On-chain transactions as key indicators in blockchain popularity

On-chain transactions are the most important indicator of blockchain's potential to either just survive or make progress. It acts like a heartbeat of those networks, which is useful for investors and users to understand the vitality of blockchain truly.

The bigger the volume of on-chain transactions, the more potential for this network to thrive. For those who are investing in digital assets, it's really helpful to watch how transactions move through a blockchain network and compare them to other protocols. Observing this close will let you know how popular and practical a particular blockchain is. Now you can know if a blockchain project is keeping up and growing or if it's starting to look like a thing of the past and will soon be left behind.

If you can see that network transactions are increasing, then it often can mean a sign of more network use - more people are trading there, so interest in the network is growing, according to experts. You can see new ways the protocol is being used or even a wave of speculative trading. If you detect a decrease in these transactions, this can be a red flag, which means that the network's development is slowing down, the protocol is losing its edge, or it's losing market share to competitors.

Knowing what factors can influence trading volumes in the blockchain can be helpful in understanding the constantly changing crypto market. When there are times of market optimism, you will see that trading volumes usually increase in particular blockchains. It may depend on good news, like clearer rules and regulations, big institutions starting to use the blockchain, or important improvements to the protocol. This is how it looks when the trading spike goes up.

Market mood is also playing an important role here. When people are feeling positive about the market, they often move their trading to decentralized exchanges. This leads to more on-chain transactions. They tend to trade more in new and innovative things like NFTs and lesser-known tokens, which affect on-chain activity more than the big tokens traded on centralized exchanges. So here is another factor where you can detect the growing trading volumes when the market is up.

But when the market is down, trading volumes often fall. This can happen during times of uncertainty, bad news, or when the market is correcting itself. Investors can feel a bit confused - they might want to wait and see what happens next, which leads to decreasing transactions. They might also move their assets to safer places, which lowers the amount of trading on exchanges.

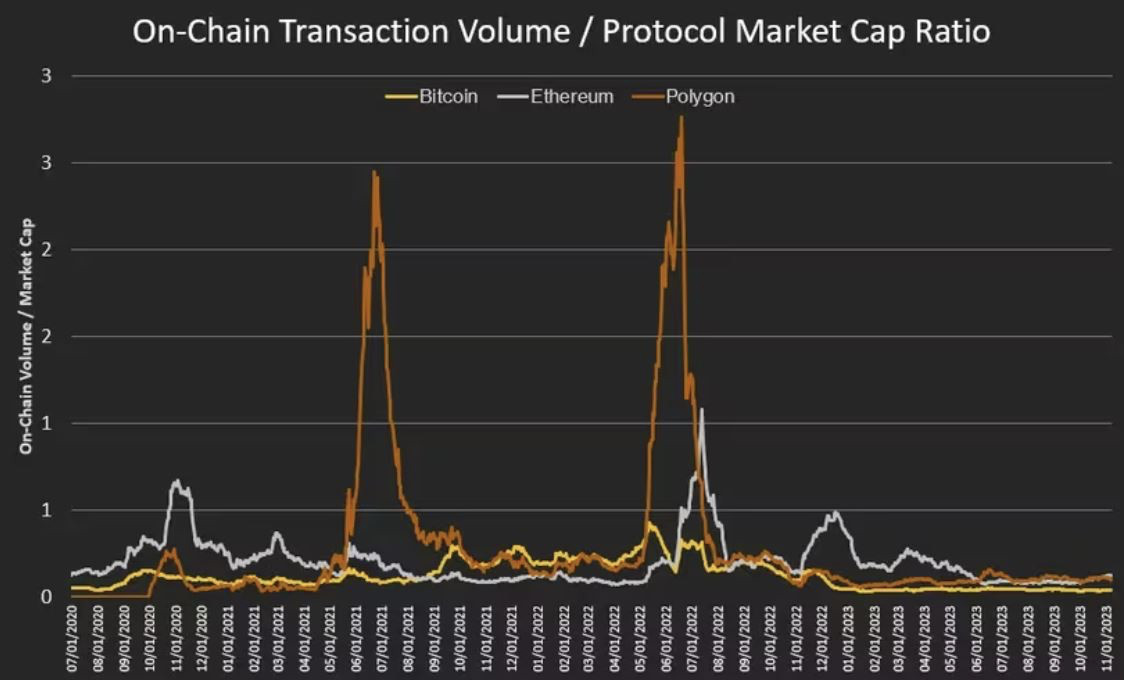

To better understand the on-chain transaction volumes, take a look at data from Sonarverse. In this Sonaverse platform, we can see on-chain trading dollar volume data by protocol, and then we can compare this data for Bitcoin, Ethereum, and Polygon. We simply need to adjust the volumes for each protocol's market value by dividing transaction volume from the market capitalization of the protocol. In the figure, we can see how Bitcoin's transaction volume is relatively low and steady, while Ethereum and Polygon have more varied activity. This makes sense, especially when Polygon helps scale Ethereum-based protocols (Polygon supports a popular Ethereum scaling ecosystem, which is known for its EVM compatibility and remarkable user experience).

Figure 1: On-Chain Trading Volume / Market Capitalization, by protocol, 30d smoothed

Figure 1: On-Chain Trading Volume / Market Capitalization, by protocol, 30d smoothed

This data can be very valuable when you want to invest, for example, in Ethereum or Polygon rather than in both tokens at the same time, comparing on-chain blockchain protocol transaction volume. It means it is more valuable to invest in Polygon when Polygon's normalized activity is higher than Ethereum's. Otherwise, it is better to stay with Ethereum. It minimizes the risk and increases return over the crypto market cycle.

So use the on-chain trading volume data, which gives the insights that help you focus on those blockchain protocols with more recent activity and more demand.

Imagine you're a crypto enthusiast, much like those early Bitcoin fans who used to eagerly analyze every movement in the blockchain. Understanding on-chain activity is a lot like that – it's a treasure hunt for clues in the digital world. It's not just numbers and graphs; it's about feeling the market's rhythm, almost like you're having a conversation with the blockchain itself.

When the market's abuzz and trading volumes are high, it's like being at a lively crypto party where everyone's talking about the next big thing. This excitement can be a sign of potential profits but also a nudge to tread carefully amidst the buzz. In quieter times, when trading slows down, it's like those early, hushed mornings of the crypto world. To the observant eye, these might be moments to discover undervalued gems, a chance to buy when others are hesitant.

Keeping track of on-chain transaction volumes and total value locked (TVL) is like having your finger on the pulse of the crypto world - helping you navigate through the twists and turns of blockchain protocols in the crypto world.